The cannabis vapor category in the U.S. has cemented itself as one of the industry’s most innovative and fastest-evolving spaces in 2025. Flower still commands the lion’s share of sales, but vaporizers now consistently rank as the second-largest product type across regulated markets. Their appeal is strongest among Gen Z and Millennials, who together drive over 70% of spending, drawn by discreet use, convenience, and smoother delivery.

Consumer Demand and Form-Factor Shifts

Vapes account for roughly one-fifth to one-quarter of dispensary sales in many markets, making them a cornerstone of the modern cannabis menu. Disposable all-in-one devices are leading growth. Consumers value their zero-maintenance design, portability, and reduced clogging compared to older 510-thread cartridges. In response, hardware makers are investing heavily in clog-resistant and leak-proof technologies, from dual airflow systems to redesigned seals. Proprietary pod systems are also gaining traction, often paired with premium oils to lock in customer loyalty.

Oil Evolution: Distillate, Live Resin, and Solventless Premium

The oils inside these devices have shifted dramatically. Distillate still anchors the value tier, but live resin has become the flavor-driven standard for many consumers. The premium story belongs to solventless rosin, which has posted triple-digit growth in sales since 2023. Brands are actively designing hardware specifically for these thicker, terpene-rich oils, using ceramic cores and heaters that operate at lower temperatures to protect flavor and aroma. The result: better vapor quality and a closer experience to traditional cannabis.

Hardware and Technology Innovations

Advancements in hardware are defining the category in 2025:

- Clog and Leak Resistance – Postless tanks, refined seals, and new airflow geometries now appear across most leading devices.

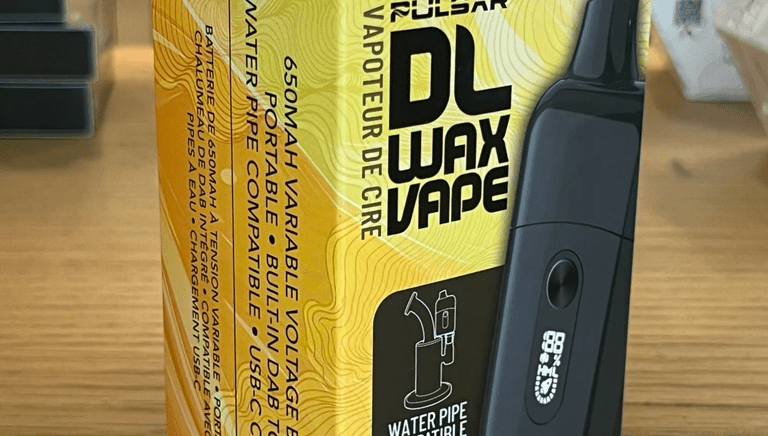

- Optimized Heaters – Platforms like CCELL’s EVO and HeRo are engineered for viscous extracts such as live resin and rosin, ensuring smoother hits without dry burns.

- Smart Features – Devices from PAX, Puffco, and DaVinci bring app integration, dosage tracking, and customizable temperature settings, bridging cannabis hardware with lifestyle electronics.

- Sustainability Moves – Early-stage biodegradable housings and improved battery removal systems are debuting, signaling a shift toward eco-conscious design.

Regulation, Standards, and Safety

The regulatory environment is catching up with the technology. California’s 2025 rules introduced strict limits on heavy metals such as lead, cadmium, and arsenic in inhalable products, pushing brands to prove compliance before reaching shelves. Nationally, ASTM International continues expanding vape-specific standards, including toxicology assessments and emissions testing protocols. Together, these efforts are building consumer trust and providing clearer guardrails for manufacturers.

Brand Landscape and Market Dynamics

Legacy names like Select and Jetty remain influential, but the competitive field is diversifying. Regional brands and private-label players are leveraging solventless and live resin products to carve out premium niches. At the same time, value-focused disposables dominate top-seller lists, creating a “barbell market” where consumers either trade up for connoisseur-level flavor or trade down for convenience and affordability.

What’s Next

In 2025, vaporizers sit at the intersection of cannabis culture, consumer electronics, and regulatory oversight. The future looks like a dual path: mass-market disposables offering simplicity and affordability, and high-end devices delivering solventless purity with tech-enhanced personalization. For retailers, success lies in carrying both ends of this spectrum, while staying ahead of evolving compliance standards. For consumers, the vape market offers more choice, higher safety, and better quality than ever before.